Choosing Insurance Coverage

This week I received the packet information for choosing health coverage. Unlike majority of the people, I am not overwhelmed by the dreaded material and I actually enjoy looking at it and comparing it from the coverage I currently have. My individual premium has gone up but that is no different from any other year (even without the Affordable Care Act in place). But the plan also raised Raytheon's annual contribution to my Health Savings Account (HSA).

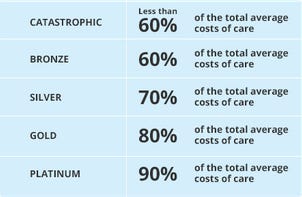

Many people I've talked to don't pay much attention to choosing the most beneficial coverage for themselves. With the number of mailings and the repulsive demeanor that choosing insurances, it's not really a surprise people hate doing it. I can't state much about the Online Marketplaces setup due to the Affordable Care Act but it is organized into 5 categories based on coverage:

Most plans cover preventive care and a percentage of other health costs. Of course, the more coverage, the more you will pay yourself. So you must decide yourself how healthy you expect to be next year. With the rate of health care costs increases, you will be paying high prices for care and health insurance is the primary source of providing for it. If you plan to be healthy like me, you can get something with a high deductible and low premiums. If your employer offers insurance, you're most likely to get the best deal from them.

And don't forget Dental and Vision! Bad teeth? Get a dental plan with higher premiums. Bad Vision? Get a basic vision plan and try to buy contacts/glasses online (much cheaper).

Two things common accounts:

Flexible Spending Account (FSA)- If you plan on spending money on medication, co-pays, deductibles, health supplies next year, put money in this account (up to $2500). The money put in this account is tax-free. But be warned, you will lose the money that's not spent for the year. So the tip here is to spend any money left in the account at the end of the year on stuff you may use later (e.g. First Aid Kits).

Health Savings Account (HSA)- Like FSAs, money put in this account is tax-free (up . Unlike FSAs, HSAs roll over year to year like investment accounts (e.g. IRAs) and the growth is tax-free too. Similar to IRAs, you can invest your money on selections based on your insurance provider. HSAs also transfer with you if you change jobs and such too.

Here is the list of items/services you can pay for using your FSA or HSA. As you can see, FSAs are much more flexible in spending (as it is in the name) but remember it is "use it or lose it" money.

Just spend some time looking at your options. It's relatively simple and don't let the "choosing insurance is complex" mentality get in the way. Health care costs are nothing to leave unattended especially if you get into an accident. While I'm not a professional, I'll help you if you need it. Just leave a comment!